SaaS Competition 101 for PMs

How to understand and beat your competitors while not getting distracted

TL;DR - Every SaaS startup will have competitors, if not yet then soon. A simple competitive strategy works most of the time: first find out where you’re unusually good and they’re unusually weak. Then build a roadmap that solves top customer problems with solutions designed to target that overlap between your strengths and your competitors’ weaknesses. Beyond that basic strategy, I’ll also share a few techniques that I’ve found to be useful when building products that customers love…and love more than the competition!

SaaS Product Managers hear contradictory advice when it comes to competitors:

Don’t worry about the competition; instead focus on making customers happy!

Be obsessed with beating your competition!

The answer, of course, is “both”. You need to build great products, and you need to ensure that your customers choose your great products instead of someone else’s.

I’ve spent many years in highly-competitive B2B markets at Microsoft, then at Splunk, and most recently as Head of Product at Cantaloupe which is the largest SaaS provider in the global vending industry. At each of these companies, I had a lot of fun taking market share from entrenched competitors while fending off upstarts. Of course I made some painful mistakes too.

Below I’ll share some ideas and techniques that I’ve found useful in competitive environments. This post will be most familiar to PMs working in SaaS startups targeting midsize-to-enterprise customers, although many lessons may be more universal.

To beat competitors, first you need great products and customer love

Competitive strategy only matters if your customers like using your products and working with your company! A PM’s top-priority responsibility is understanding what customers need most and improving the product to meet those needs.

Competitive strategy is about *how* to improve your products in ways that will make it easier for customers to pick your product when it’s being compared head-to-head with others.

My favorite competitive strategy is trivially simple: build stuff that customers need that your competitors can’t easily build.

Compete where you have an unfair advantage

The worst thing you can do is to go up against a competitor where they’re strong. Don’t start a price war with a competitor backed by Softbank or Tiger. Don’t try to compete with Apple on hardware design. Don’t compete with Oracle on the sleaziness of your Sales team. They will always win.

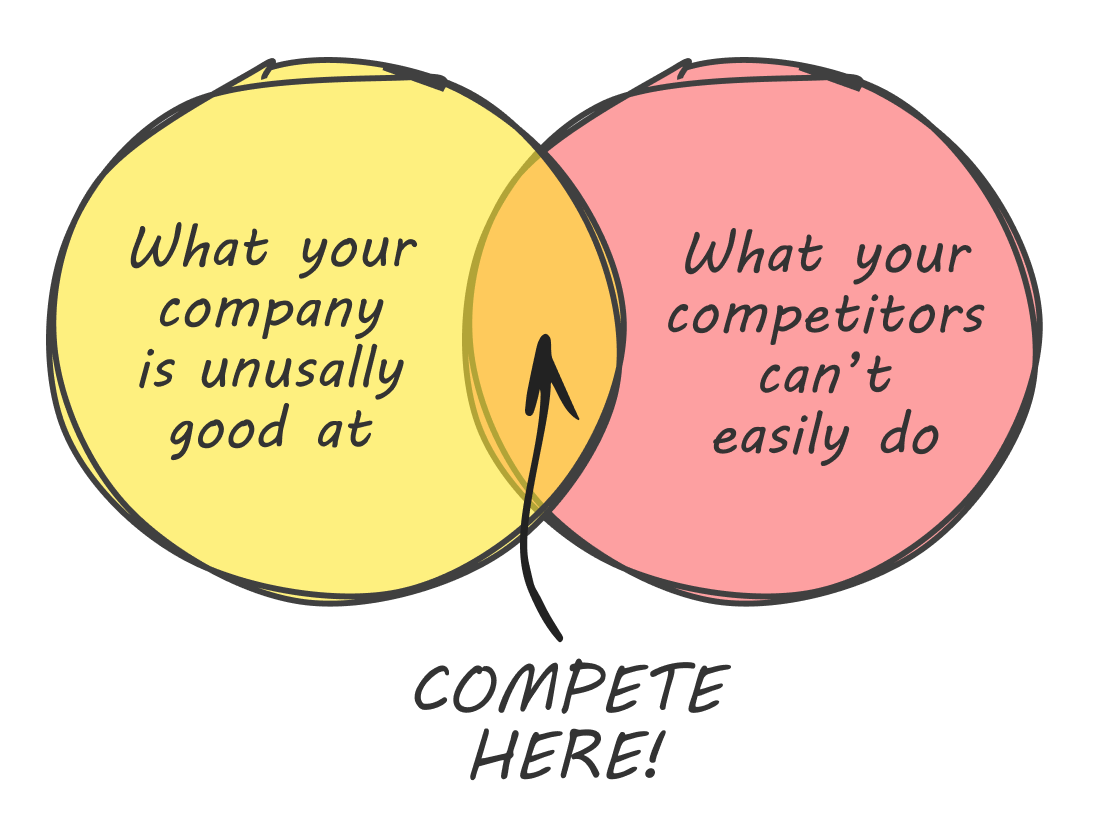

Instead, I use a two-question framework to find opportunities to beat competition:

What is my company *much* better at than my competitors?

Where are my competitors unable to compete?

Your job as a PM is to find the intersection of those two sets, and lean into it!

It’s important to honestly appraise long-term differences between your company and the competition. Ignore transient wins that are easy to copy, like a great feature or high market share. What matters are “moats”: strengths of yours and corresponding weaknesses of your competitors that will stick around for years. Maybe forever.

Lately my favorite example of this strategy is Convex, a startup that’s competing with AWS and other cloud providers by making it easier for JavaScript developers to store data and run code in the cloud. AWS’s strengths are low cost, high scale, and wide range of services. AWS’s weakness stems from its fundamental philosophy that favors high scale, low price, and multi-service architecture. The result is a poor fit for developers who just want an easy, scalable way to store cloud data and run cloud code without complex configurations or integrations. Fundamental technical philosophy is *very* hard to change, which makes it a good target to compete against!

Another example is Apple’s M1 processors in 2020-and-later Macs that “essentially process twice as many instructions as AMD and Intel CPUs at the same clock frequency” while delivering up to 2x the battery life of high-end Windows laptops. In an industry where competitors are usually within a few percent of each other, this is an astounding leap.

Apple made this leap—conveniently for the purpose of this post!—by focusing their improvements in areas where their competitors can’t easily match:

Apple achieved performance, power, and probably cost gains using a SoC (“System-on-a-Chip”) architecture. This SoC approach works vastly better—both technically and as a business model—if the CPU, computer hardware, and OS are all designed by the same company. That “same company” doesn’t exist in the PC world.

The M1 processor’s lowest-level language (“ARM instruction set”) is particularly well-suited for huge performance gains that Intel and AMD cannot match because their x86 instruction set is required to stay backwards-compatible with older processors.

This was smart competitive strategy. Apple could have put R&D into other areas that would also improve speed or battery life, but instead they chose to focus innovation where their competitors were fundamentally constrained by business model, technical architecture, and/or backwards compatibility. This means that to catch up to Apple, competitors can’t just clone what Apple did—they need to find brand-new innovation, which is much harder and riskier.

Competitive case study: turning “feature-rich” into a liability

This section is a case study from my own experience at putting this “invest where you’re strong and they’re weak” competitive strategy into practice.

At Cantaloupe, our largest competitor was a conglomerate that sold vending machines (we didn’t sell those) but who’d many years before acquired a vending-focused software product that *did* compete with us. The competitor’s software was the unquestioned industry leader: it was reliable, widely used, and very feature-rich. It had been the best software in our industry for almost 10 years. Also, because our competitor’s primary business was selling hardware, they invested minimally in software R&D and were happy to sell their fully-depreciated software at a very low price (or even give it away for free!) to customers who bought hardware too.

Therefore, competing with them on feature parity or price would have been a long, expensive mistake because we’d be playing where they had a home-court advantage. Instead, we targeted their weaknesses.

Their biggest weakness was, as is typical of successful incumbents, that their tech was old. Their main product was built on “client-server” architecture, requiring Windows desktop apps and an on-premises SQL Server database. Ours was a cloud-based system. So we focused our sales and marketing strategy around around the advantages of the cloud: easy to work from home or on the road, can use any computer or even iPads, no need to pay for buying and maintaining an on-premises server, etc. Ironically, the same thing that made their product successful—hundreds of features—made it impossible for them to respond quickly because moving to the cloud would mean rewriting all of them.

We used the same strategy against their high-quality, feature-rich mobile app for drivers who filled vending machines. Like all mobile apps in the vending industry in the early 2010s (including ours!) our competitor’s app ran on ancient Windows Mobile ruggedized handheld devices that cost more than $1000 and broke down frequently. We knew that the competitor’s mobile app—like their desktop app described above—had a long feature list. Porting it to another platform would take years. So we stopped all non-critical investment in our own Windows Mobile app and tasked our team to build an iOS native app that could run on sub-$200 iPod Touch devices, iPads, or users’ own iPhones. Even though the V1.0 mobile app we shipped had only a fraction of features, because it ran on a cheaper, more reliable, and more usable platform we could already use it as a competitive wedge to win customers.

A side effect of going after competitors where they’re weak is that your “offense” often forces them to play defense if they start losing business to you. In the case described above, our competitor did eventually release a native iOS mobile app and moved at least part of their software to the cloud. But this was a massively expensive project for them. This work kept much of their team busy for several years! By investing in areas where our competitor would struggle, it distracted them and prevented them from threatening us where they were strong but we were weak.

Of course, while you’re trying to force your competitor to compete where you’re strong, smart competitors will be trying to do the same thing to you. Don’t take the bait! Don’t assume you need to respond to everything a competitor does. Be willing to lose deals in areas where your competitor is too strong, so that you can stay focused on areas where you’re stronger. It’s a game of chicken; the longer you can stay focused on your own strengths, the better your chance of winning the game.

Feature parity 101: when and how to compete where they’re strong

So far in this post, I’ve tried to convince you not to fight the competition on their home turf, and not to get sucked into a feature-by-feature slog with an entrenched competitor. But this advice isn’t universal. As you move upmarket, you’ll likely bump into the bane of every SaaS company’s existence: “feature parity”, where large customers insist you fill feature gaps relative to competitors.

In the early days of most SaaS companies, competitive feature parity is not important…because it’s not possible! You can’t build in 6-12 months what the competition has built over 6-12 years. Instead, you should carve out a niche where your features are 10x better than anyone else, and you need to sell those features to early adopters who tolerate your gaps in return for a best-of-breed solution in a narrow area.

But as your product matures, you’ll run out of early adopters! Also, you’ll start landing larger and more complex deals. You might even start taking business away from once-untouchable competitors. But what you’ll find with these larger deals is that feature gaps can be deal breakers. This is especially true when you’re trying to eject a competitor from an account, because you’re not only competing with a competitor’s salesperson. You’re also convincing an entire company, often hundreds of people, to change how they work by adopting your theoretically-better product over the competitor’s unloved-but-familiar product.

In those cases, your customer will typically present you with a list of feature gaps. It usually sounds like this: “We love your product and we want to throw out [competitor’s product “X”]. But X does a really great job at A and B. If you build those things, we’ve got a deal.” If this is the only customer who’s ever asked for A and B, read my post How to Avoid Building Custom Features for One SaaS Customer! And if the customer asks you to fill 20 different gaps or gaps you can’t realistically fill, then you’ll have to say no.

But if you’re hearing the same few feature gaps in many high-value deals, you might decide that it’s time to stop losing those deals. It’s time for feature parity…at least in those features. Here’s how I approach it.

First, the default answer should always be “no”. Customers and salespeople love to blame feature gaps for not closing deals. Often the deal can be done anyways, given the right incentives. If I’m not 90%+ confident that a feature is really needed to close a lot of business or prevent a lot of churn, then I’ll partner with Sales to see if we can solve the gap with money instead of engineering, or otherwise stall to see if the deal gets done anyways.

But in cases where stalling is not possible, what next? I’ve learned from painful experience what *not* to do: don’t spend a lot of effort building a feature that’s roughly the same as the competitor’s. This may solve your immediate sales pain, but it’s easy to fill up your roadmap with parity work and still not catch up to an entrenched competitor for many years. Chasing parity can slowly bleed your company to death.

Instead, I generally bifurcate all feature parity decisions into two strategies: “least effort” for most features and “leapfrog” for a few rare cases. In other words, either get to “good enough” with a bare minimum investment, or deliver something that’s so much better than the competitor that what was previously your weakness is now your strength. I avoid the middle path that fills up the roadmap but doesn’t generate sales or marketing wins.

Feature parity example: “least effort”

A good example of “least effort” came when my Head of Sales called me late one evening. Our largest customer—who’d recently turned off our competitor’s software and was now using ours instead—was very unhappy and threatening to go back to the competitor.

The problem: many tasks were taking their team 5x+ longer than when using the competitor because our app was slow to display very large datasets on some pages. This customer’s staff were waiting 3 minutes for some pages to load! This was a known problem on a few pages of our JavaScript-heavy web app. This didn’t affect our competitors’ native Windows client apps, but our previous customers using these features were smaller so our pokiness had never been a big problem. But the customer’s team was used to our competitor’s product that loaded equivalent data in under one second. I didn’t blame them for being upset!

We had two options: delay our roadmap by a month to re-tool how our app displayed large tables of data and match our competitors’ sub-second load time, or figure out a cheap way to make this customer’s pain less bad. We chose the latter. After a day or two of tactical fixes, we reduced three-minute load times to 45 seconds. Still awful, but better. Later, we deployed another fix that brought it down to 15 seconds. Still annoyingly slow, but that was fast enough that the customer stopped threatening to churn.

This episode was classic least effort: we didn’t try to beat the competition; we just tried to make our gaps “less bad enough” to avoid losing business.

Feature parity example: “leapfrog”

My favorite win against this same competitor—and an example of “leapfrog” feature parity—was in reporting features. Our competitor’s product had hundreds of high-quality canned reports, and used a solid Crystal Reports-based reporting UX that allowed advanced customers to hire database developers to build custom reports directly against the local SQL database. Our product, on the other hand, had limited reporting features, few canned reports, and no self-service custom reports. If a prospect’s top priority was reporting, we’d lose the deal.

We’d had a big reporting overhaul on the backlog for a while, and in the meantime we were improving reports in a “least effort” fashion while we worked on higher-priority stuff. Then we got big news: our top competitor had just acquired its largest competitor. The acquired product was even more ancient—many of its customers still ran a DOS version! But the acquired product had one huge advantage: a much-loved reporting feature that let non-technical users build custom reports without hiring a database developer.

Like most B2B acquisitions, we assumed that within the next two years the acquirer would try to force acquired customers to migrate to the acquirer’s software. This was an opportunity to win those customers. If they must switch, why not switch to us?

One problem: our reporting sucked. We had neither easy custom reports like the acquired competitor, nor the massive library of custom reports and SQL-level extensibility like the acquiring competitor.

After learning the acquisition news, we decided to leapfrog the competition. It was a massive effort: a big chunk of engineering time for more than a year. But in the end, this big bet paid off. We went from worst-in-the-industry reporting features to best-in-the-industry. This unblocked many sales deals and further frustrated our top competitor by converting many of their acquired-company’s customers!

Note that we didn’t try to get reporting feature parity everywhere. We still didn’t have a way to do SQL-level custom reporting like our top competitor offered. Instead, we focused leapfrogging investment where it mattered most: on acquired-company customers who really liked what their old product gave them: the ability for non-technical users to make custom reports. This was an important lesson: even when leapfrogging, you still need to be very selective about *where* and *why* to invest.

Different competitive strategies for different competitors

To understand a competitor, I’ve found it helpful to understand what *kind* of competitor it is. I divide them into five types:

Legacy Competitors: established players in your industry with mature products. These competitors tend to be larger, slower-moving, better capitalized, more feature-rich, more sales-and-marketing-focused with weaker engineering, and better known than your company and its products.

Emerging Competitors: smaller startups going after you and the legacy competition… just like your company did when it was a brand-new startup!

Unexpected Competitors: companies from an unrelated industry who are taking business from you and your competition. For example, at Cantaloupe our customers (vending operators) often had a line of business called “Office Coffee Service” that delivered coffee, snacks, and supplies to corporate break rooms. Costco and Amazon have started to play for that business by delivering similar products at lower prices. For our customers who were used to peer competitors only, this was a shock.

Bad Competitors: companies who aren’t executing effectively. They might have always been bad, or they might be legacy or peer competitors who have lost their way.

Peer Competitors: companies like yours, Hertz and Budget if you’re Avis. Or United vs. Delta. Similar size, similar customers, similar market.

For each kind of competitor, you’ll need a different competitive strategy:

Legacy Competitors are the best competitors for startups! They’re slow, they make lots of $$$, and customers often hate them. Taking business away from legacy competitors is also where most of a startup’s revenue comes from after early adopters are exhausted. For these reasons, I generally try to steer towards legacy competitors because they’re relatively easy to beat, and because their customers are usually so grateful that they’ll reward you with praise and money when you give them something better.

To Emerging Competitors, *you’re* the legacy! The playbook here is usually straightforward: most smaller-than-you startups have a thin product, few reference customers, sloppy engineering, bad reliability, and will probably go out of business in a few years. The goal: prevent these competitors from getting a toehold in customer segments you care about most. It’s mostly up to the Sales team to accomplish this, so I think PMs should worry less about these startups as competitors and more as opportunities: for learning other ways of solving the same problems, as potential partners, as potential acquisition targets, etc.

To compete with Unexpected Competitors, the trick is usually to leverage your better knowledge about the customer and the industry. When a big company from another industry tries to muscle in, they often have advantages, e.g. better pricing, more scale, etc. This may mean conceding “commodity” lines of business to them. But they have a weak spot: they haven’t spent years specializing their product and company around your industry like you have. Exploit that unfamiliarity! For example, imagine I run a same-day delivery business and DoorDash or Amazon or Uber enters my market. I might choose to give up the generic “deliver anything” market where they will have the advantage in scale and/or price. But I might specialize (and win!) in more complex deliveries with unusual logistical, legal, or other requirements: medications (need temperature control and/or special legal controls), flowers (need to be kept fresh), frozen foods (need a freezer), construction materials (need a flatbed truck), and so on.

Bad Competitors are an interesting case. First, you need to be sure they really are bad. Talk with their customers to confirm. Second, beware of legal or interpersonal issues; when companies are on their way down, they often try to take others with them. Third, these are often prime acquisition targets, because they often have a long list of dissatisfied current customers that you can mine for leads. Just be aware that customers who have stuck with a Bad Competitor for this long may be so change-averse that they may not be easy to close nor a good customer afterwards, so the value of that customer list should be discounted. Otherwise, they are good targets for your Sales team but from the Product side I usually don’t worry much about them.

Peer Competitors are my least favorite. If a competitor is a similar size and maturity as your company, then it’s harder to find areas where they’re weak and you’re strong, and easier for them to do the same to you. Unlike the others above, there’s no simple strategy that works for peer competitors. You’ll have to figure it out on a case-by-case basis. My only advice is to try to avoid head-to-head matchups with peers. Often you both lose. It’s usually better to find parts of the market where peers aren’t playing, and claim those niches before your peer competitors can respond. Once you’re entrenched, it will be harder to boot you out.

As an established startup, you’ll likely have all 5 kinds of competitors. But there’s only have one roadmap! For this reason, I’m always on the lookout for product investments that address multiple kinds of competitors at once, often for different reasons.

For example, Cantaloupe’s revamped reporting features (see “leapfrog” above) addressed all five competitor types. Our new technically-challenging reporting back-end put parity out of reach of all competitors except the Unexpected category. And the vending-industry-specific data that we were reporting ensured that an Unexpected Competitor would be unlikely to get the results right, even with great data-science tech.

“Defend against everyone” features like our reporting work also tend to be the most valuable from customers’ POV too, so they usually rise to the top of every roadmap.

Competitors help you learn quicker

A nice thing about competition is that it helps you understand your own market better. You learn which business strategies and features resonate with customers and which don’t. Competition helps an entire industry get better faster and deliver better products to customers and users. I think this is the gist of Brett’s advice below.

Here’s a few quick tips for using competition to learn about your customers and your industry:

Whenever I chat with a customer, I politely ask what they think about the competition. I ask what they like, what they don’t, and anything particularly cool or awful that they’ve seen. As long as you keep the focus on what the customer thinks (“What do you like about product X? Do you think that they do a better job at feature A than we do?”) then most customers are happy to share. Occasionally customers are shy about some things (e.g. pricing is often a sensitive topic) so don’t push it.

When visiting a customer who uses a competitor’s product, I often try to get a demo where they show me what they like and don’t like about the product. Just be careful not to seem like you’re using the customer to sneakily gather private info about the competitor. Don’t push it. As noted above, the best way for this not to feel awkward is to ask the customer about their opinions and let them lead you to the right info. For example, instead of “Could you show me the New Report feature of this product?” try this instead: “I noticed that there’s a “New Report” button on your screen. Do you use that feature?” Then pause and wait. 9 times out of 10, they’ll click the button and give you a demo, while giving you a detailed review of what they like and don’t like!

It’s helpful to join competitors’ webinars, drop by their booth at conferences, and otherwise get a holistic view of how they’re talking to their customers. By watching how customers respond to someone else’s sales and marketing pitch, it’s a good way to judge whether your own company’s messaging is on-target or not.

When our company would lose a deal, we’d always do a “lost deal analysis” where the salesperson (or sometimes the Head of Sales, or occasionally even the CEO) would check in with the customer to understand more about why we lost the deal. This info is invaluable, but needs to be extracted humbly and politely. We’d often check back in with a lost deal 6-12 months down the line, where info is often more unfiltered and useful than the immediate aftermath of a lost deal, because the honeymoon period is over and the customer wants to gripe. BTW, this is a great time for Sales to try to try to win the customer back.

Other Tips & Tricks for SaaS Competition

This section is a few observations that may help when thinking about competition, and also some competitive practices or techniques that I’ve found useful.

Don’t badmouth your competitors

My one iron rule for competition: I never talk trash about competitors in public, in the press, or (especially) in front of customers. Customers *hate* it when vendors badmouth each other because it puts the customer in an awkward position, especially if they have to work with both companies. Don’t do this!

Also, it’s common for employees to switch companies in the same industry. If you’re known as a company that’s disrespectful towards competitors, it gets harder to attract good talent from competitors who may not want to join that culture. Also, you’ll attract jerks who *do* like that culture.

Competitors will train customers to pay for software. That’s good!

In SaaS, your biggest “competitor” is often not another product: it’s a free combination of Excel, email, post-it notes, and other ad-hoc solutions that your customers have been using to solve a problem that you want to solve with your software.

This often means that new products who lack competition from other software vendors still must compete with the status quo. They need to convince customers that the in-house duct-tape solution should be thrown away in favor of your (probably expensive) product. This can be hard, especially when there’s an internal constituency for the duct tape solution.

So often it can be helpful to have competing products in a market, because they have already trained customers to pay for software to solve a problem. In my experience, it’s often easier to dislodge a competitor than to kick out a bad internally-developed solution.

Your competitors are better and more numerous than you probably think

Most people in most companies are overly confident about their competitive position. They start to believe the marketing spin exemplified in “feature checklists” like the one below, where your company is all green while the competition has lots of missing parts.

It’s normal for the marketing team to think that way, but as PMs we need to be more objective and clear-eyed about our competitors. A good way to be reminded of this is to visit or meet with our competitors’ reference customers (often I’d tag along with salespeople for this) to see the best examples of our competitors’ products in action, and to hear what their biggest champions say about them. It’s humbling, but it’s also a useful anchor to reality.

Also, never say “we have no competition”. By claiming you don’t, it makes you sound like you haven’t done your homework or are arrogant. Probably both.

Competition isn’t only about features

From a SaaS customer’s POV, the “product” they’re buying is actually the *company*, not the software. I first learned this at Splunk; the product got much better over time, but when I first joined it was hard to set up, hard to use, and hard to extend. But our Support team was great, so if a user had a problem they called or emailed Support and quickly got back on track.

I saw the same at Cantaloupe, where customers were willing to pay a higher price because working with our company was easier than the competitors: we had good support, our salespeople were more ethical, and our people were more focused on solving customer problems.

The takeaway is to compete at end-to-end customer experience: not just product features but also documentation, support, billing, salespeople, and more. I’ve repeatedly seen that over-investing in customer relationships makes it easier to sell high-margin products and to beat low-price/bad-service competition.

For more about widening your too-product-centric worldview, check out Product is a Feature (of the Service).

When Should You Worry About a Competitor?

Most industries are crowded. You probably have 20+ competitors: usually a few large players and many smaller startups trying to claw their way to the top. But it’s not a good use of scarce time to become an expert in all of those small startups. Most will fail and time you spend on them will be wasted.

Instead, I typically use a simple heuristic for where to focus my competitive attention:

Competitors who are strongest among “stretch” customers. The typical path in SaaS is to start with smaller customers and gradually move upmarket. This means that the most challenging deals to win are on the “leading edge” of your customer base: customers as large or slightly larger than your current largest customers. In order to win more of those leading-edge customers, you need to beat competitors who play there. Keep in mind that winning the first stretch customer will likely be *very* expensive in every dimension: engineering work, sales discounts/rebates, customer service, etc. The second, third, etc. should get cheaper (aka more profitable) as your company gets used to handling customers of that scale.

Competitors I hear a lot about from Sales. Good salespeople often (although not always!) have a sixth sense of whether a competitor is a threat or not, because they spend every day talking with customers and therefore hear which companies are really a competitive threat vs. a vapor threat. Customers will sometimes exaggerate the chance of a competitor winning a deal in order to extract concessions, and some salespeople won’t see through this strategy. So don’t over-react. But if I hear about the same company showing up in competitive deals across multiple salespeople, then it’s probably worth learning more about that competitor.

Competitors I want to learn more about. These can be potential acquisition targets, potential partners, companies with interesting technology or business plans, or other factors that make the competitor more than just “a company I want to take business from”.

A simpler approach is to only pay attention to a competitor until you start losing deals to them, which ensures that you don’t waste time on vapor competition. But I think this is too risky, because losing deals is a lagging indicator. By the time a competitor beats you in an important deal, they may have enough inertia that they’ll be able to beat you in other deals too, and it may be too late to catch them easily. It’s easier and cheaper to head them off when they haven’t matured enough to actually beat you in deals.

One thing I don’t focus on is competitors who are getting a lot of buzz in the press, but who aren’t actually showing up in competitive sales situations and who don’t seem to fall into the “want to learn more about” bucket above. Some companies are better at getting attention than others. Don’t get distracted. The only attention that really matters is the attention that comes out of customers’ wallets. 😊

Happy competing!